1. Centered Moving Average versus Arithmetic Progression.

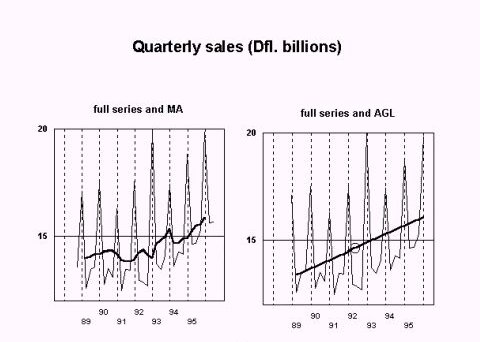

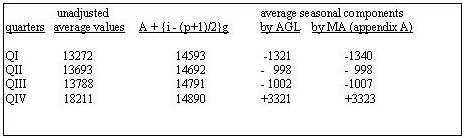

In the illustration "Quarterly Sales" a time series (quoted in Appendix A) is depicted, on the left side including a centered moving average (MA), on the right side an "average growth line" (AGL) is added. The series depicts a 7-years stretch (1989 through 1995) of quarterly sales of consumer durables. The terms of the inspected section of the series will be called y1 through y28. At both extremes two terms have been added (y0, y-1, y29, y30) to allow the centered moving average to reach all the terms of the inspected section. Centered moving average: The average value for each group of corresponding quarters, as calculated from the moving average, will be called "unseasonal quarter averages". If these unseasonal quarter averages are subtracted from the quarter averages of the full series we obtain a (preliminary) set of average seasonal components. Average growth line: The average growth line is a straight line through the series' average value (A). A = å yi /28 (i = 1, 2, ….., 28) The gradient of this line is the average change ("growth", g) of each term over the preceding term: g = å (yi -yi-1)/28 = (y28 -y0)/28 (i=1,2,…..,28) The average value for each group of corresponding quarters as calculated from the average growth line coordinates will also be called "unseasonal quarter averages" and they are represented by an arithmetic progression with difference g and average value A: A - 1.5g , A - 0.5g , A + 0.5g , A + 1.5 g In general terms the progression can be expressed as: A + {i - (p+1)/2}g, (p = periodicity, i = 1, 2, …, p) (formula 1) Table 1: seasonal components. Full calculation in Appendix A A = 14741 g = 99  Some reflection will make it clear, that unseasonal quarter averages as calculated from the moving average and from the average growth line coordinates should be the same - with the exception that the moving average includes two more terms at the beginning of the series and at the end of the series. But for this exception , moving average and arithmetic progression would render the same seasonal pattern. This will be elaborated below. Which terms figure in a corresponding-quarters-average of a centered moving average? The average for quarters I includes:

The first-quarters-average is arrived at by dividing the total by (7 x 4 x 2 =) 56.

Likewise for the other groups of quarters:

The average value (A) of the inspected section of the series = å yi / 28 (i= 1, 2, …,28). The quarter averages can be rewritten as:

The inside-brackets part of each quarter-average represents growth over the full section of the series, always from a quarter at the beginning of a series to a corresponding quarter at the very end. If unseasonal fluctuations do not distinguish between the periods of the year and if no outliers would occur in the relevant terms, then these growth figures should be more or less the same. This average growth will be called g ', where g ' is variable. g ' = (ye - yb)/28 (ye indicates a quarter in the last year of the series, yb a corresponding quarter at the beginning, where e - b = 28). The quarter averages can now be rewritten as:

This formula is similar to formula 1(unseasonal quarter averages from an average growth line). But here g ' is variable and g ' = (ye - yb)/28 includes the additional terms at the extremes of the relevant section of the time series. What would be the advantage of a variable g '? Above the inconvenience of delay I can only think of reasons to reject variability of g ': |